Is RFID Protection Necessary?

I mention a lot about wallets which include RFID protection as part of a wallet’s offering. But I never really talk about whether contactless card fraud is actually an issue in the first place. Sure, this type of crime does exist but the real question we should be asking is ‘am I at risk’? We don’t stop flying because we know there is a small chance the plane could crash. If the risk is low for anything enough we weigh up the risk and make our decision based on that.

The same can be said for contactless fraud. If the chances of getting scammed are less than 0.1% then would it really be worth paying extra money for RFID Functionality in a wallet? Likewise, if this was the reverse I definitely would as my chances of being subject to this crime dramatically increase. This article is going into some detail regarding the use of contactless payment systems in countries across the world and how we can use this information to gauge who is most at risk of succumbing to this type of crime.

Below we’ve written an FAQ regarding RFID and to go through many of the most asked questions regarding this feature and discuss in detail whether or not its worth having this technology integrated in your wallet.

What are Contactless Cards?

Contactless cards contain a particular chip that emits radio waves that can be easily read by a payment terminal. Using contactless cuts out the extra time taken to tap in your pin and therefore payments are faster.

However, you can only spend up to a maximum of £30 per purchase (depending on the country) as a security feature. Banks have also put a further safeguard that requires the user to insert their pin code ‘randomly’ after a few contactless uses. This should help ensure that only someone authorized is using the card and not a fraudster. However, when asked, banks would not reveal how often they made these checks.

What Is RFID Protection?

RFID Technology is the name given to the preventative measure built into many wallets that aims to stop contactless card fraud from happening. The acronym RFID stands for ‘Radiofrequency identification’. This technology blocks the contactless ‘radio’ signals from working correctly shielding your credit or debit cards from working.

Am I at risk of contactless Fraud?

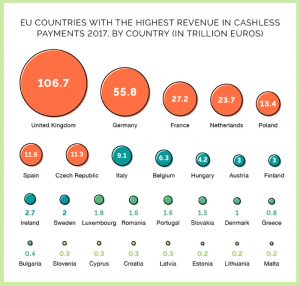

Although I couldn’t find any specific research on the exact number of fraudulent causes, per country, using contactless technology we can use the data we have on the most used countries to hypothesize the countries most likely to suffer from this crime.

With this, we can assume that the higher the usage rate of contactless payments in a given country the higher the rate of crimes committed. This would simply be down to criminals being aware the technology exists, using it to their advantage, and because the chances of success would be higher as more people use the technology.

There is very little evidence that RFID shielding is a serious threat to consumers, due to many reasons mentioned in the article, as data encryption and use of EMV Chips make this kind of crime very rare.

Should I buy a wallet with RFID Secuirty?

Do some research on how much your country uses RFID protection. If you’re in a country where contactless payment is rarely used then I wouldn’t say it was either worth considering RFID protection in your wallet, especially if the wallet you want charges an additional fee for the feature (which many do).

Likewise, if you can from any country in the top 10, such as The United Kingdom, Germany, or China, then you should very much consider purchasing a wallet with RFID protection as your chances of being subject to this crime are statically higher.

For example, I’m from the UK who has one of the highest usage rates in the world. But, personally speaking, I’ve never come across a situation where I found myself getting scammed or have ever gotten scammed (I also use contactless cards at least once per day). That being said, we aren’t considering the individual provinces of each nation. Areas of a country where crime is simply higher might be more susceptible. There’s no clear cut answer here.

My recommendation is to do your own due diligence. Consider your own country, your town, and the crime levels there. Make an informed choice based on your life. If you feel at risk then its best to play it safe. If not, then you can save some money on RFID which usually comes at a premium. For more information on RFID and to view a comprehensive list of wallets with the technology check out our reviews with the link below.

What is Contactless Fraud?

In a nutshell, Contactless Fraud is a criminal activity where thefts target the wireless technology integrated in your credit or debit cards. They use so-called ‘skimming’ devices (very much like the normal machines used to pay for items in-store) that automatically charge and deduct payments from your cards.

These criminals usually hang around shops that use contactless payments and try and place the device next to where they think your wallet is. This crime is often very successful due to the discrete nature of it. Criminals can often get away with it as you won’t know you’ve been targeted until after the fact.

Are contactless Payments on the rise?

The global contactless payments market is driven by reduced transaction time, convenience in processing low-value payments, and increased revenue opportunities. However, high costs involved for the installation of EPOS terminals and a lower rate of adoption hamper the contactless payments market growth along with cultural variations in how citizens of a country view money. That being said, as the technology improves and becomes cheaper to the business to install and use this adoption rate can dramatically increase and at a faster rate. An example of this is China where one of the biggest payment providers in the country, along with help from the government, helped create an economy built on this technology.

The simple answer is yes, but it really depends on the country you’re in and their individual cultures when it comes to money. For example, most of Europe has in some shape or form been very adopting contactless payments. Perhaps this is something you’d expect from many of the world’s richest countries. On the contrary, though, The United States, while having the largest economy in the world, falls short when it comes to this. Shops are reluctant to implement the technology and customers have no choice to sit to more traditional forms of payment. China is the same in reverse. A less prosperous nation overall but a high adopter.

I think it has more to do with a cultural view of money in a given nation. A good example to take in Japan. In Japan, cash is king. A report from Japan’s industry ministry last year found that just 18.4 percent of payments in Japan were made without cash, compared to 60 percent in China. Japan is one of the wealthiest countries in the world yet a culture of using physical cash is important in Japan and contactless payments are just not popular.

What Counties use contactless payments the most?

The graphic below shows the countries that use this type of contactless payments the most in Europe. Although there is a lack of evidence of whether increased use of contactless payments in a country directly correlates with crime rates its definitely work taking a look.